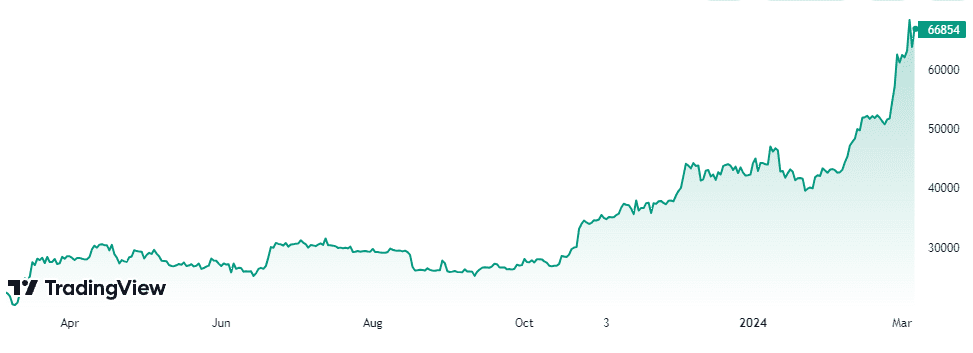

Bitcoin, the world’s leading cryptocurrency, made headlines recently by reaching a historic high of $69,202 only to experience a sharp correction, losing roughly 7% of its value. This rollercoaster pattern isn’t entirely new to Bitcoin, but what exactly fueled the surge, and why did it plummet so quickly?

Understanding the Factors Behind Bitcoin’s Rise

Numerous forces contributed to Bitcoin’s meteoric rise:

- Institutional Investors Embrace Crypto: Traditional financial giants are increasingly adopting Bitcoin, signaling a turning point in cryptocurrency acceptance.

- U.S. Spot ETF Approvals: The Securities and Exchange Commission’s (SEC) recent approval of spot Bitcoin ETFs has boosted investor confidence.

- Potential Interest Rate Cuts: Growing anticipation of the Federal Reserve cutting U.S. interest rates often pushes investments into higher-yield or riskier assets like cryptocurrencies.

- Bitcoin’s Halving Event: The upcoming “halving” event, where rewards offered to Bitcoin miners are cut in half, often creates excitement by reducing future supply.

Why the Sudden Crash?

Even amidst bullish sentiment, Bitcoin remains a notoriously volatile asset. Here’s what might have triggered the sudden downturn:

- Profit-Taking: Investors who bought Bitcoin earlier may have cashed out some of their profits after the significant price increase.

- Spillover from Risk-On Sentiment: Bitcoin’s rally mirrored the broader market’s “risk-on” momentum, driven by factors like interest rate speculation, making it vulnerable to larger market shifts.

Bitcoin and Gold: A Shifting Correlation

Interestingly, Bitcoin is finding some acceptance as a “digital gold” or hedge against inflation in uncertain economic times. Gold also recently reached a record high, and experts suggest crypto might benefit from a perceived correlation.

The Crypto Landscape Beyond Bitcoin

While Bitcoin remains the leader, other cryptocurrencies and blockchain concepts show growing potential:

- Ethereum: The world’s second-largest cryptocurrency, Ethereum, though off its highs, represents the foundation of numerous blockchain-based projects.

- Stablecoins: Dollar-pegged assets like Tether are crucial for trading crypto, with Tether’s market capitalization surpassing $100 billion.

- Corporate Adoption: From software firms to social media platforms, companies are exploring the potential use of cryptocurrencies.

Investor Takeaway: Volatility and Potential

Bitcoin’s recent price swings highlight the inherent volatility in the cryptocurrency market while also showcasing its potential for high returns. Investors must carefully consider their risk tolerance and conduct thorough research before investing in Bitcoin or any other cryptocurrency.